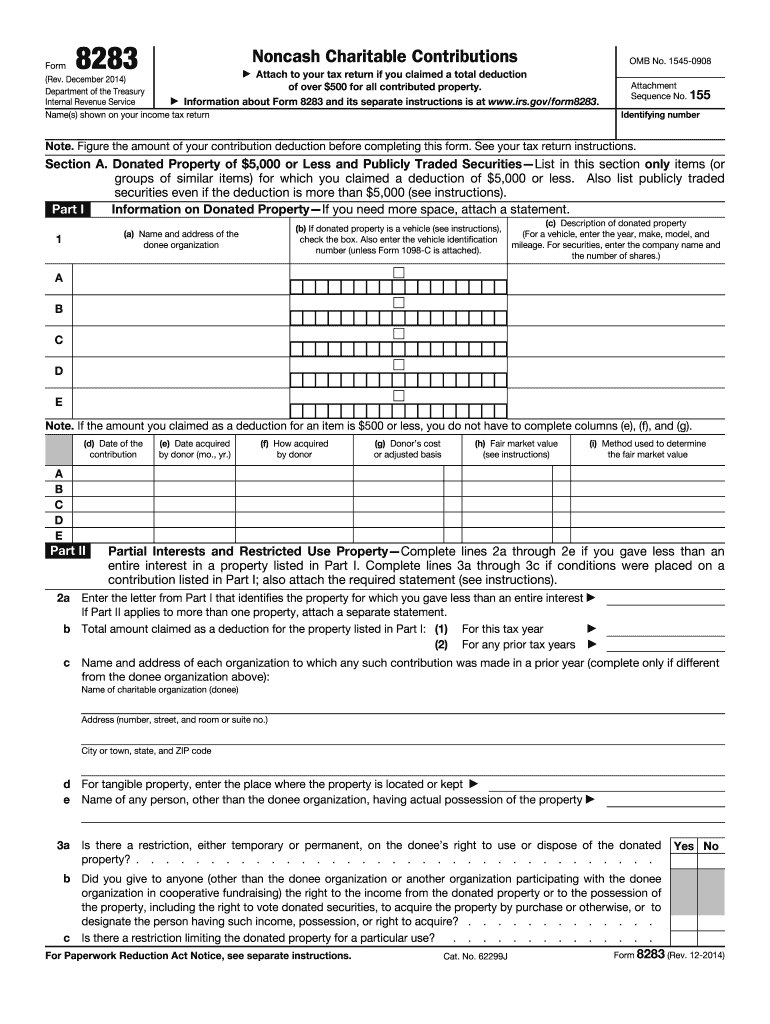

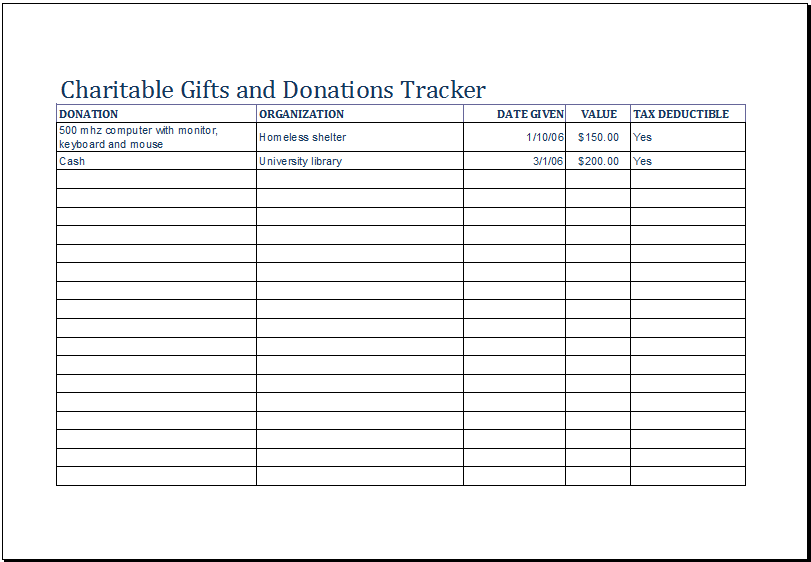

Non Cash Charitable Contributions Donations Worksheet. Deductions for noncash contributions are reported as itemized deductions. Learn about the value of your Salvation Army donation with per item valuation in our handy guide.

Tax deductible donations are contributions of money or goods to a tax-exempt organization such Your charitable giving will qualify for a tax deduction only if it goes to a tax-exempt organization, as defined by Before you donate, ask the charity how much of your contribution will be tax-deductible.

Charitable Solutions, LLC in Jacksonville, FL helps charities manage non-cash donations and gifts in risk-free ways.

Clients can rely on our expertise and use a Has your charity ever refused a donation of a non-cash or illiquid asset for one of these reasons? Deductions for noncash contributions are reported as itemized deductions. Donations to qualified charities are tax-deductible expenses that can reduce your taxable income and lower your tax bill.