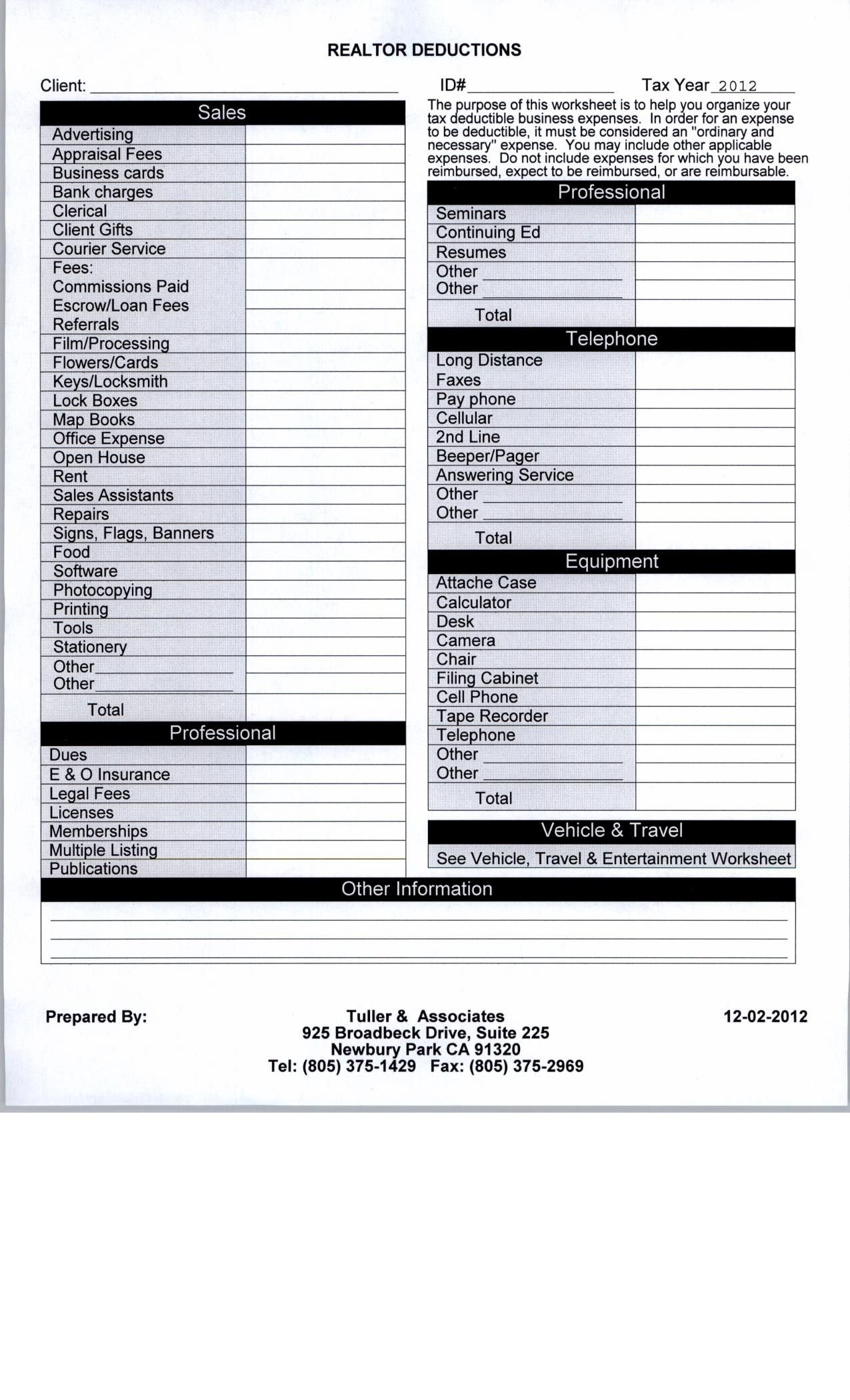

Self Employment Tax Worksheet. It will also calculate the amount of your self-employment tax deduction and let you know how much you owe in additional Medicare tax if you are over the income threshold. If you're not sure where something goes don't worry, every expense on here, except for meals, is deducted at the same rate.

To view the Self-Employment Tax Adjustment Worksheet in your TaxAct® return: TaxAct Online Users: Sign in to your TaxAct Online return; Click Tools on the right side of the screen to expand the category, then click Forms Assistant

As you may know, small business owners and self-employed workers often have to pay estimated taxes four times a year.

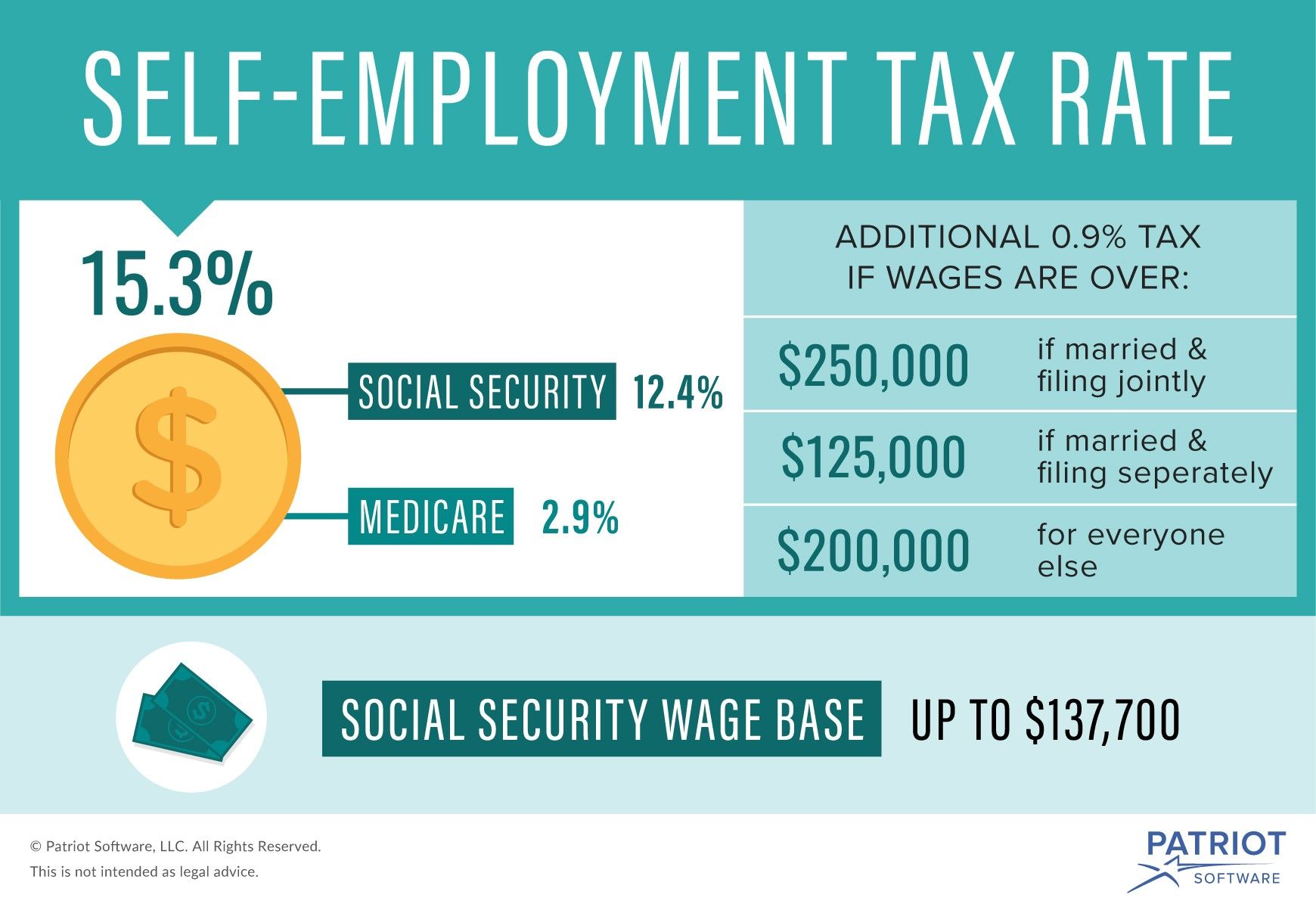

There are a number of credits that you can claim on your tax return and it is helpful to determine what the various credits are, so you can take advantage of them. Individuals qualifying for the self-employment tax include those who. Self-Employment Tax Rate The law sets the self-employment tax rate as a percentage of your net earnings from self-employment.